Is Cryptocurrency Mining still profitable in 2019?

Is Cryptocurrency Mining still profitable in 2019?

In this modern age, internet as made so many things very easy. There are so many things you can do online these days which includes making money online. One of the numerous ways of making money online is crypto currency mining.

I know most of you might have heard about cryptocurrency mining and might have found it difficult to understand, well I strongly believe that after reading this article, you will understand it and know how profitable it is. Understanding how cryptocurrency mining works takes a lot of patience, it is not something you can rush into, you have to learn it in steps, the people who are mining already will understand what I am saying. This article will help you with that. For you to know how cryptocurrency mining works, you have to know the meaning, the pros and cons, the basic concepts, the coins to mine, the equipments to use and so on. So let’s start with the definition.

Definition of cryptocurrency

A cryptocurrency is “a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets”. It was also defined according to Merriam-Webster as “any form of currency that only exists digitally, that usually has no central issuing or regulating authority but instead uses a decentralized system to record transactions and manage the issuance of new units, and that relies on cryptography to prevent counterfeiting and fraudulent transactions. The summary of this definition is that crypto currency is an online medium of exchange. It doesn’t have a central authority like the Bank of England in the United Kingdom or The People’s Bank of China. It only depends strongly on Cryptography to prevent fraudulent activities. Cryptography simply means the use of codes to protect a particular information making the information visible only to the intended recipient.

Brief History of Cryptocurrencies

The first and the most popular decentralized crypto currency which is Bitcoin was invented by a Japanese Sakashi Nakamoto. Although it was not recorded if that is the inventor’s real name but that is the alias used by the person or group of persons that invented the first crypto currency. It all started in October 2008 when nakamoto published an article on metzdowd.com about the new digital currency it was titled “Bitcoin: A Peer-To-Peer Electronic Cash System”. In January 2009, Nakamoto released the first Bitcoin software that launched the first units of crypto currency which was called Bitcoin. On the third day of January 2009, Nakamoto mined the ” Genesis Block of Bitcoin ” i.e the first block of Bitcoin and he was rewarded 50 Bitcoins. In December 2017 those Bitcoins were valued at over 19millionUSD which would have made him the 44th richest person in the world then.

Now that you know the basic definition of crypto currency now let’s take a look at the pros and cons.

PROS

- Decentralization. The cryptocurrency network doesn’t have any main authority, the network is distributed to all participants, each computer mining bitcoins is a member of this system.This means that the central authority has no power to dictate rules for owners of bitcoins. And even if some part of the network goes offline, the payment system will continue to operate stable.

- No Inflation: There are so many things that can decrease the purchasing power of a Nation’s currency like; change in government, increased import prices, excess supply of money and so on. But crypto currency doesn’t have any authority governing it and with the maximum number of coins limited to 21 millions Bitcoins,there is a very low possibility of inflation.

- Unlimited Transactions: For a normal currency there are limits to how and where you can use the currency but there is no limit to the transactions you can make with crypto currency. Each wallet holder can pay any amount for anything to anybody at any time. The transactions cannot be controlled or prevented by any authority, so you can make transfers to another wallet holder anywhere.

- Easy to use: Opening a bank account in some part of the world can be very hard and takes too long before it is opened and starts working but using a crypto currency wallet is more convenient. Why? Because it only takes less than 10 minutes to open a crypto currency wallet and immediately start to use it without any objections or commission.

- Sole Ownership: There is a very unique electronic payment system where the account belongs to the owner only. For example, on PayPal if for any reason the company decides that the owner somehow uses the account in a wrong way, the system has the right to freeze all funds on the account without even warning the owner about it. Verification of the proper usage of account is the total responsibility of the owner. With crypto currency, the owner has a private key and a corresponding public key, which is the address to the crypto currencywallet. No one but the owner can withdraw.

- Reduced fraudulent activities: Nowadays, if you want to make payments online, you’d have to use your credit card and to do that you would have to fill some forms where you will disclose pieces of information like your credit card number, expiration date and so on. Therefore, making credit card theft more rampant. Crypto currency transactions does not require the disclosure of any personal information. Rather it makes use of two keys: public and private. The public key is displayed to all but the private key is only known by the owner. A transaction cannot be completed without the private key to make sure the transaction was completed by the owner.

- Anonymity: With crypto currency, you can create tons of wallets without reference to names, address or any other personal information.

- Transparency: All the transactions made using any form of crypto currency are stored and recorded, using a technology called Blockchain. The Blockchain records everything so if you use a crypto address publicly every one will know the amount of crypto currency you own. But if you do not use it publicly nobody will know it belongs to you. So for complete anonymity and transparency, companies use their unique code for all transactions.

- Highly secured: All the transactions made using crypto currency is secured because of the use of a very strong cryptography. It impossible for anybody other than the owner to use the wallet. Unless your wallet is hacked and there are so many ways to protect yourself from being hacked so you can be rest assured that your wallet is safe.

CONS

- Not widely accepted: one of the charactistic of a good currency is for it to the widely accepted and spent. But right now, Crypto currency is not yet known around the world so it makes it difficult to make transactions especially in a place where crypto currency is not yet accepted. This is one of the shortcomings of crypto currency.

- Ignorance: Like I said earlier most people don’t know that investing in crypto currency mining is somehow complex it requires a lot of patience, they juat rush into it without proper understanding thereby opening themselves to hackers.

- Payment reversal is hard: If you mistakenly pay for a transaction using crypto currency, it is so hard to reverse the payment unless you ask the person for refund and in most cases refunds are not made. So it needs one to be careful all the time before making any transaction.

- Higher risk on investment: The volatile nature of crypto currency makes investing in it very risky. Risks like hacking, money laundering and any other type of illegal financial activities. And there is no central issuer which means there is no legal formal guaranty in case of bankruptcy.

Now that you know the basic definition of crypto currency now let’s take a look at the pros and cons.

Definition of most important terms when handling Cryptocurrencies

For you to have a knowledge about how crypto currency works, you have to know the fundamental concepts like:

Cryptography: It is also known as Encryption. It involves writing and solving codes. Therefore, cryptography is the process of using codes to secure information and transaction so that only the person to whom the information is intended can access it.

Decentralization: Crypto currency doesn’t not rely on any central authority to regulate it. It depends on things like cryptography, peer-to-peer blockchain for its creation and regulation. No central authority can control the currency.

Digital: The general currencies in circulation can be seen and touched because they are defined by a physical object. For example British pound sterling is printed on a paper. But crypto currencies are digital i.e it is not defined by a physical object. Digital coins are sent from a digital wallet to another person’s digital wallet.

Value: For a currency to be an effective medium of exchange, it must have value. What makes a currency valuable? It is the scarcity and the hard work required to own it. If everybody can easily get the currency without working for it, then it will lose it’s value.

Public Ledger: This is the place where all the transaction since the beginning of crypto currency are kept. The identities of the coins owner and the legitimacy of each transactions are secured and ensured respectively using cryptography. The public ledger is also known as “The Transaction Blockchain”.

Transaction: Transaction is the transfer of funds from one digital account to another digital account. The transaction is Submitted to the public ledger for confirmation. Wallets uses an encrypted electronic signature called cryptographic signature when a transaction is made. This is to proof that the transaction really came from the owner of the wallet.

Mining: It can also ne called cryptomining. This is the process of confirming transactions and adding them to a public ledger and also releasing new currencies. To add a transaction to the public ledger, the “Miner” will need a computer and a special software to be able to compete with other miners in solving a required complicated mathematical problem.

Fork: A fork occurs when an original crypto currency is spilit into two to make another version. A fork is created mostly to correct the flaws of the original crypto currency.

Now that you know everything about crypto currency, it’s time to know the best and the most profitable crypto currencies to mine.

THE MOST PROFITABLE CRYPTO CURRENCIES TO MINE

Bitcoin (BTC): Although Bitcoin is the first crypto currency that was introduced into the digital market in 2009, it is still considered one of the most profitable crypto currencies in the market. It costs around $5600 to mine each Bitcoin effectively while the price of one Bitcoin is within the range of $8000 to $10572 so miners can expect nothing less than $2400 profit. Isn’t that a good profit? Yes it is.

Ravencoin (RVN): Ravencoin was launched on on the third of January 2018 as a fork of Bitcoin. It is also known as “fair mining”. It is no longer a secret that many people wants digital currency mining centralized. Wealthy investors are paying miners to mine and are providing them with up to date computers and software making it hard for ordinary miners to compete with them especially in Bitcoin and Altcoin mining. However Ravencoin is designed to level the playing ground because of the X16R algorithm that it uses in mining. That is why Ravencoin is considered one of the best crypto currencies to mine.

Monero (XMR): Monero was created in April 2014 as a fork of Bytecoin. It’s popularity in the crypto currency world is rising because of it’s privacy. It hashing algorithm known as ” Cryptonight” makes its transaction safe and untraceable. Monero is very easy to mine, all you need to do is download and install the Monero mining software. It’s all this characteristic that makes Monero a profitable crypto currency to mine.

Litecoin(LTC): Litecoin was released in 7 October as a fork of Bitcoin. That is why it is almost the same with Bitcoin. It is a peer-to-peer crypto currency project released under the MIT/X11 license. It has a storage capacity and it’s confirmation is faster. It currently ranks 4th Largest crypto currency in the world in terms of market capitalization. These features makes it one of that best crypto currencies to mine 2019.

Feathercoin (FTC): Feather coin Is an upgraded and customized version of Bitcoin.Although it is a fork of Litecoin, but it was launched in 2013 as an alternative to Bitcoin with a smaller trading volume. FTC uses Neo hashing algorithm for its transaction. It also supports desktop wallet,mobile wallet and block explorer. With FTC you can also make transactions anonymously.

Ethereum (ETH): Also known as Ether. After Bitcoin, Ethereum ranks the second crypto currency in the world in terms of market capitalization. So therefore, your list of the most profitable crypto currency to mine can never be complete without adding Ethereum. Ethereum was released 30th July 2015.

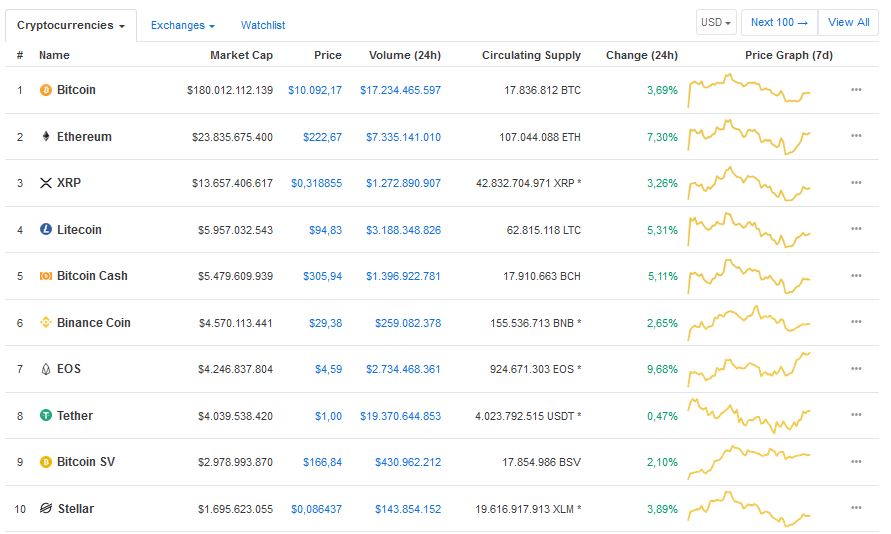

And the list goes on and on like that. Added below is the picture of crypto currency ranking according to market capitalization.

Profitable ways to mine Cryptocurrencies

Before you can mine for profit, there are certain things you must consider like: the cost of your equipments, the efficiency of your equipments and mining software, energy cost, rent, equipment cooling cost, cost of electricity and so on because these are the things that will determine whether you make profit or loss.

There are four basic ways to mine crypto currencies they include: CPU mining,GPU mining,Bandwidth mining,ASIC mining but out of all this methods only GPU mining is highly recommended because it is profitable, more efficient, not expensive and easy to maintain. The best GPUs used for mining are currently made by Nvidia and AMD and the best way to mine with this method is to find new strong crypto currency mine them and quickly sell them for profit.

The other ways of mining are also profitable but most of them are very expensive to get and very hard to maintain. For example ASIC mining (application-specific integrated circuit) is also profitable in fact it is the most profitable but it is very expensive in terms of hardware and energy consumption. And with ASIC, you can only mine specific coin like Bitcoin and Litecoin. However, GPU mining is easily accessible to home users.

Out of all this methods, CPU mining is the least efficient. Why? Because it was the first method ever uses by Bitcoin and over the years, it became more difficult to mine and the energy consumption as increased massively Mining the majority crypto currencies with this method might not be profitable.

In conclusion, like I said earlier mining crypto currencies for profit is somehow complex. So before you go into it, sit down,think it through, draw your plan, check out the coin, the software and the equipment that suits your plan then you are good to go. Most people call crypto currency mining so many name like illegal money, hacker’s money and so on but I can boldy tell you that crypto currency mining is the future of currency because its not all about making money, it’s about making money better.